CM Life Insurance Scheme 2025

The Khyber Pakhtunkhwa (KPK) administration has presented a new CM Life Insurance Scheme to deliver financial security to inhabitants in case of the demise of the family’s main worker. This year, the initiative will spend Rs. 4.5 billion to help families facing financial difficulties. This scheme is connected to the KPK government’s larger agenda for welfare with Chief Minister Ali Amin Gandapur, building on Imran Khan’s Naya Pakistan idea.

More Read:CM Punjab Aghosh Program 2025

Below is a quick overview of the KPK CM Life Insurance Scheme 2025:

| Detail | Information |

| Program Name | KPK CM Life Insurance Scheme 2024 |

| Start Date | 2024 (Exact date to be announced) |

| End Date | Ongoing (Yearly renewal expected) |

| Financial Assistance | – Below 60 years: Rs. 1 million – Above 60 years: Rs. 5 million |

| Application Method | Expected to be online (Details to be confirmed) |

| Eligibility | All residents of KPK (No class discrimination) |

KPK CM Life Insurance Scheme 2025 – Key Features & Benefits

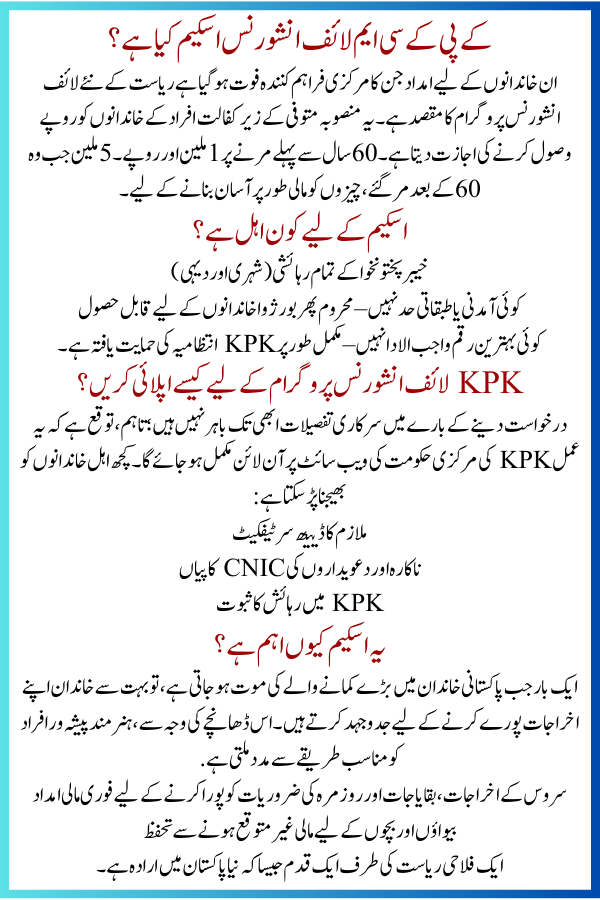

What is the KPK CM Life Insurance Scheme?

Support for families whose main provider has died is the purpose of the state’s new life insurance program. The plan allows families of deceased dependants to receive Rs. 1 million when the person died before 60 and Rs. 5 million when they died after 60, to make things easier financially.

Who is Eligible for the Scheme?

- All residents of Khyber Pakhtunkhwa (Urban & Rural)

- No income or class limits – Obtainable for deprived then bourgeois families

- No best sum obligatory – Fully backed by the KPK administration

More Read:Honhaar Scholarship Phase 2

How to Apply for the KPK Life Insurance Program?

Official details about applying are not out yet; however, it is expected that the process will be completed online on the main KPK government website. Some qualifying families may have to send:

- Death certificate of the employee

- CNIC copies of the defunct and contenders

- Proof of residence in KPK

Why is This Scheme Important?

Once the major earner in a Pakistani family dies, many families struggle to make ends meet. Because of this structure, skilled professionals are properly supported.

- Immediate financial aid to cover service expenditures, arrears, and everyday needs

- Protection for widows and children from financial unpredictability

- A step towards a welfare state as intended in Naya Pakistan

More Read:CM Punjab Wheat Support Program 2025

Comparison with Other Provincial Schemes

Contrasting other shires, KPK is the first to present a life protection scheme together with the Sehat Card Plus program, making it a leader in shared welfare creativities.

| Province | Health Insurance | Life Insurance | Financial Aid on Death |

| KPK | Yes (Sehat Card) | Yes (New CM Scheme) | Up to Rs. 5 million |

| Punjab | Yes (Sehat Card) | No | Limited aid programs |

| Sindh | Partial coverage | No | Minimal support |

| Balochistan | Limited | No | None |

Future Plans & Expansion

The KPK administration has oblique at more well-being schemes, counting:

- Increased health coverage under Sehat Postcard Plus

- Educational scholarships for children

- Employment support for relations who lose their stipendiaries

More Read:BISP 8171 Web Portal May Payments 2025

Conclusion – A Step Towards Financial Security

The KPK CM Life Insurance Program 2025 is a milestone inventiveness to protect relatives from financial destruction after the death of a worker. By Rs. 4.5 billion owed yearly, the package is usual to gain lots.

For updates, residents should squared the official KPK government website or call local enabling centers. This scheme emphasizes KPK’s obligation to public welfare, setting an illustration for other boondocks to follow.

FAQs

Is the KPK Life Insurance Program free?

You don’t have to make payments because the government finances it.

How much money will the family receive?

- Rs. 1 million if the deceased was below 60.

- Rs. 5 million if the deceased was above 60.

When will the scheme start?

Yet we don’t have the opening years yet, the scheme is for the outline to alter dynamic in 2024.

Can people from other provinces apply?

Only residents of KPK can apply.

What documents are needed for registration?

- CNIC of dead & family

- Death diploma

- Proof of KPK house

3 thoughts on “KPK Govt Launches New CM Life Insurance Scheme 2025– Complete Guide for Residents”