Akhuwat Interest-Free Loan 2025

The Akhuwat Interest-Free Loan Program 2025 is a radical monetary inventiveness in Pakistan intended to deliver Qarz-e-Hasna (interest-free loans) to worthy individuals. Whether you vital funds for business, education, health, agriculture, or crises, Akhuwat Basis proposals a Sharia-compliant, interest-free solution to assistance you achieve financial stability.

Since its inception, Akhuwat Interest-Free Loan has aided over 1 million Pakistanis seepage lack by offering easy payment plans without any concealed custodies. Unlike old-style banks, Akhuwat operates on compassion and trust, ensuring that debtors are not loaded by high-interest rates.

More Read: BISP Dynamic Survey June 2025

Quick Overview of Akhuwat Loan Program 2025

| Detail | Information |

| Program Name | Akhuwat Interest-Free Loan Scheme 2025 |

| Start Date | Ongoing (Open throughout the year) |

| End Date | No fixed deadline (Apply anytime) |

| Loan Amount | PKR 10,000 to PKR 500,000 (varies by loan type) |

| Eligibility | Pakistani citizens, 18-60 years, low-income persons |

| Application Method | Offline (Visit nearest branch) / Online pre-registration possible |

| Official Website | www.akhuwat.org.pk |

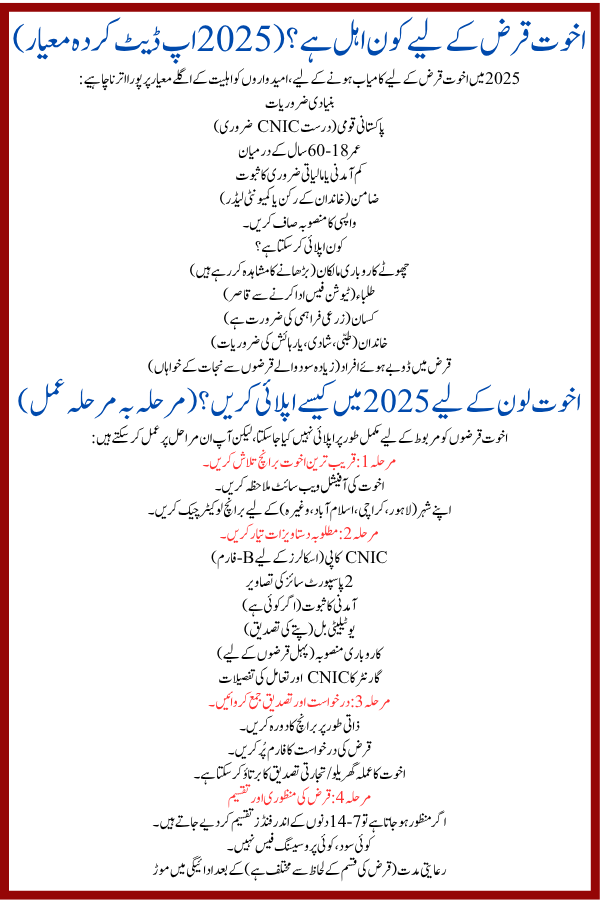

Who is Eligible for Akhuwat Loan? (2025 Updated Criteria)

To succeed for an Akhuwat loan in 2025, candidates must meet the next eligibility criteria:

- Basic Requirements

Pakistani National (Valid CNIC essential)

Age between 18-60 years

Proof of low income or fiscal essential

Guarantor (family member or community leader)

Clear repayment plan

- Who Can Apply?

- Small business owners (observing to enlarge)

- Students (unable to pay tuition fees)

- Farmers (needing agrarian provision)

- Families (medical, marriage, or housing needs)

- Debt-ridden individuals (seeking deliverance from high-interest loans)

How to Apply for Akhuwat Loan in 2025? (Step-by-Step Process)

Akhuwat loans cannot be fully applied for connected, but you can trail these steps:

Step 1: Locate Nearest Akhuwat Branch

- Visit Akhuwat’s official website

- Check the branch locator for your city (Lahore, Karachi, Islamabad, etc.)

Step 2: Prepare Required Documents

CNIC copy (B-form for scholars)

2 passport-sized photos

Proof of income (if any)

Utility bill (address confirmation)

Business plan (for initiative loans)

Guarantor’s CNIC & interaction details

Step 3: Submit Application & Verification

- Visit the branch in person

- Fill out the loan request form

- Akhuwat staff may behavior a home/commercial confirmation

Step 4: Loan Approval & Disbursement

- If approved, funds are disbursed within 7-14 days

- No interest, no processing fees

- Repayment twitches after a grace period (differs by loan type)

More Read: BISP Kafalat Payment Status June 2025

Types of Akhuwat Loans Available in 2025

Akhuwat offers manifold loan types to suit different economic needs:

- Business & Enterprise Loans (PKR 10,000 – PKR 100,000)

- For small traders, shopkeepers, and startups

- Repayment period: 6 months to 3 years

- Education Loan (PKR 10,000 – PKR 100,000)

- Covers instruction fees, records, and supplies

- Must offer fee proof after a documented organization

- Agriculture Loan (PKR 10,000 – PKR 50,000)

- Supports sharecroppers with germs, livestock, and gear

- Flexible repayment based on harvest cycles

- Health & Emergency Loan (PKR 10,000 – PKR 50,000)

- For medical treatments, operations, and crises

- Fast approval for urgent cases

- Marriage Loan (PKR 10,000 – PKR 50,000)

- Helps low-income families with bridal expenditures

- Liberation Loan (Debt Relief)

- Helps persons escape high-interest loans (like praise postcards or private lenders)

- Housing Loan (Up to PKR 500,000)

- For home construction or renovation

- Long-term payment (up to 5 years)

Repayment Process: How to Return the Loan Without Interest?

Akhuwat advances are interest-free, but debtors must pay the main quantity in easy installments.

Key Features of Repayment:

✔ No curiosity or hidden cares

✔ Flexible monthly episodes

✔ Grace period already repayment begins

✔ Early repayment tolerable (no penalties)

More Read: BISP 13500 Bonus Eid Qist June 2025

Why Choose Akhuwat Over Banks or Other Loan Schemes?

No Interest (Riba-Free) – Fully Islamic-compliant

No Complicated Paperwork – Simple certification

Community-Based Approval – No strict bank-like checks

Supports Poverty Alleviation – Empowers low-income relations

Frequently Asked Questions (FAQs)

Can I apply for Akhuwat loan online?

No, but you can check worthiness online and call the adjacent division.

What is the maximum loan amount?

Up to PKR 500,000 (for housing loans).

Is Akhuwat loan really interest-free?

Yes, 100% interest-free (Qarz-e-Hasna).

How long does approval take?

Usually 7-14 days after proof.

What if I fail to repay?

Akhuwat works with mortgagors to adjust refund plans without drawbacks.

Final Verdict: Should You Apply for Akhuwat Loan?

If you essential financial help deprived of attention, Akhuwat is the best choice in Pakistan in 2025. With easy eligibility, supple payment, and ethical backing, it’s a salvation for lots.

Visit your nearest Akhuwat branch today and take the first step to monetary freedom!

Official Website: www.akhuwat.org.pk