Punjab Rozgar Scheme 2025

If you’re a small business owner or an wishful businessperson in Punjab, the Punjab Rozgar Scheme 2025 might just be the chance you’ve been waiting for. Launched by the Government of Punjab in partnership with The Bank of Punjab (BOP) and Punjab Small Industries Corporation (PSIC), this scheme is designed to provide low-interest loans to help businesses grow, create jobs, and boost the local economy.

Whether you’re running a small shop, a startup, or a hut industry, this scheme offers financial support with flexible repayment options. The best part? It’s easy to apply, and you don’t need heavy security to qualify.

Let’s dive into the particulars so you can take full benefit of this inventiveness.

More Read:8171 BISP Payment Problem Due to PMT Score – Step-by-Step Solution

Quick Overview of Punjab Rozgar Program 2025

Before we get into the nitty-gritty, here’s a quick summary of the scheme:

| Feature | Details |

| Program Name | Punjab Rozgar Scheme 2025 |

| Start Date | Officially launched in early 2025 (exact date to be announced) |

| End Date | Ongoing (until funds last) |

| Loan Amount | Rs. 100,000 to Rs. 10,000,000 |

| Interest Rate | Subsidized (lower than market rates) |

| Eligibility | Punjab residents aged 20-50 with a business idea or existing small business |

| Application Method | Online (via official PSIC/BOP website) |

What is the Punjab Rozgar Scheme?

The Punjab Rozgar Scheme is a government-backed loan raft aimed at supporting small and average enterprises (SMEs), startups, and hut industries. The goal remains simple:

- Help businesses grow

- Create job opportunities

- Boost Punjab’s economy

This scheme is particularly useful after the monetary challenges of recent years, offering reasonable loans with easy payment plans.

More Read:8171 Web Portal New Update June 2025

Key Features of Punjab Rozgar Program 2025

Here’s what makes this scheme stand out:

- Loan Amount & Interest Rates

- Minimum Loan: Rs. 100,000

- Maximum Loan: Rs. 10,000,000

- Interest Rate: Subsidized (much lower than even bank rates)

- Loan Tenure & Repayment

- Repayment Period: 2 to 5 years

- Flexible Installments: Monthly or quarterly payments

- Who Can Apply?

- Youth (20-50 years old)

- Women entrepreneurs

- Skilled workers & small business proprietors

- Startups & existing SMEs

- No Heavy Collateral Required

Unlike traditional bank loans, this scheme is collateral-free for smaller totals, making it accessible to more people.

Objectives of Punjab Rozgar Scheme

The government has hurled this scheme by several key goals:

✅ Support small businesses struggling due to economic challenges

✅ Encourage entrepreneurship among youth and women

✅ Reduce unemployment by helping businesses hire more workers

✅ Boost Punjab’s economy by solidification local productions

More Read:3 Marla Scheme June 2025 – Apply Online

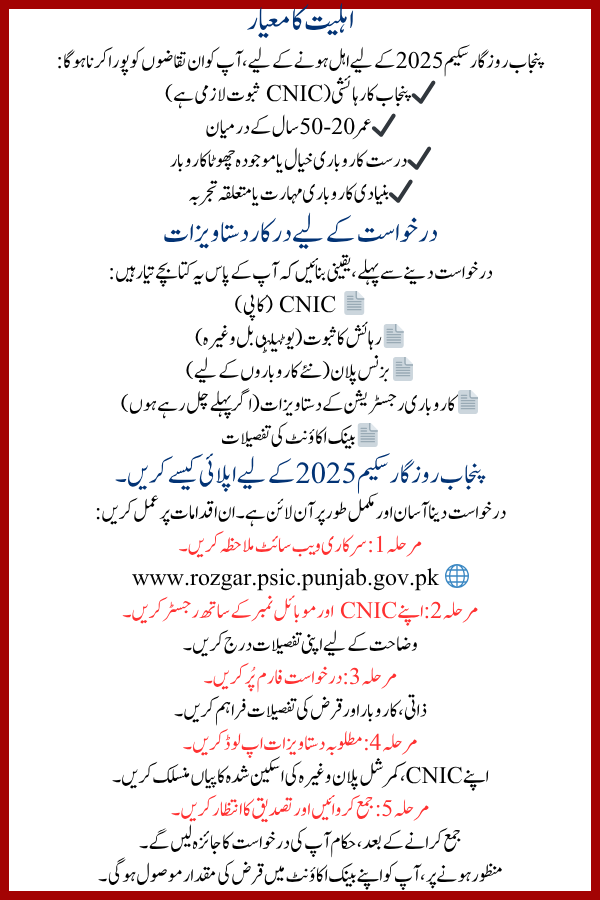

Eligibility Criteria

To qualify for the Punjab Rozgar Program 2025, you must meet these requirements:

✔ Punjab resident (CNIC proof obligatory)

✔ Age between 20-50 years

✔ Valid business idea or existing small business

✔ Basic business skills or relevant experience

Documents Required for Application

Before applying, make sure you have these leaflets ready:

CNIC (copy)

Proof of residence (utility bill, etc.)

Business plan (for new businesses)

Business registration documents (if previously running)

Bank account details

How to Apply for Punjab Rozgar Program 2025

Applying is simple and completely online. Follow these steps:

Step 1: Visit the Official Website

Step 2: Register with Your CNIC & Mobile Number

- Enter your details to create an explanation.

Step 3: Fill Out the Application Form

- Provide personal, business, and loan details.

Step 4: Upload Required Documents

- Attach scanned copies of your CNIC, commercial plan, etc.

Step 5: Submit & Wait for Verification

- Once submitted, authorities will review your application.

If approved, you’ll receive the loan quantity in your bank account.

Frequently Asked Questions (FAQs)

What is the minimum & maximum loan amount?

- Minimum: Rs. 100,000

- Maximum: Rs. 10,000,000

Is this scheme only for new businesses?

No, existing businesses can also apply for growth.

Do I need collateral for the loan?

For smaller quantities (up to Rs. 500,000), no collateral is wanted. Larger advances may require some security.

Can women apply for this scheme?

Absolutely! The scheme strongly encourages women entrepreneurs.

How long does approval take?

Typically 2-4 weeks, depending on document verification.

More Read:BISP Kafalat Payment Status June 2025

Final Thoughts: Should You Apply?

The Punjab Rozgar Program 2025 is a golden chance for small commercial owners, startups, and skilled labors to get financial support deprived of the usual bank hassles.

Low-interest loans

Easy application process

No heavy collateral required

Great for youth & women businesspersons