5Lack Loan for Business

Starting or expanding your business is no less than a dream in today’s tough economic conditions. Everyone around you seems to be talking about inflation, unemployment and rising costs. In such a situation, if the government of Pakistan itself goes ahead and gives interest-free loans to the youth, then this is a golden opportunity. Especially the youth who have entrepreneurial skills and hard work can change their destiny with this program. Under the Prime Minister’s Youth Business and Agriculture Loan Scheme (PMYB&ALS), you can get an interest-free loan of up to 5Lack Loan for Business .But remember this facility is not forever, only till July 2025 you can submit application. If you don’t act now, you will regret it later.

Get ready today, complete your documents and take your business to the next level with this loan .This article will guide you step by step so that you can apply without any difficulty.

Brief details table

| Feature | Description |

| Loan amount | A maximum of 5Lack Loan for Business |

| Black explanation | 0% (interest free) |

| Payment period | 36 months (3 years) |

| Processing Fees | 100 rupees only |

| Guarantee | Only personal assurance required |

How to get 5 lakh rupees loan without interest?

The Prime Minister’s Youth Business and Agriculture Loan Scheme has been launched by the Government of Pakistan so that young entrepreneurs and farmers can realize their dreams despite financial difficulties.The scheme has three tiers, in which the first tier (Tier 1) provides interest-free loans up to Rs 5 lakh.If you want to start a business, this is the lowest cost loan. You have to deposit only 10% equity capital while the remaining amount will be provided by the government. If your business is already running, the equity requirement is also waived.

Check Also: BISP 8171 Payment Result Check

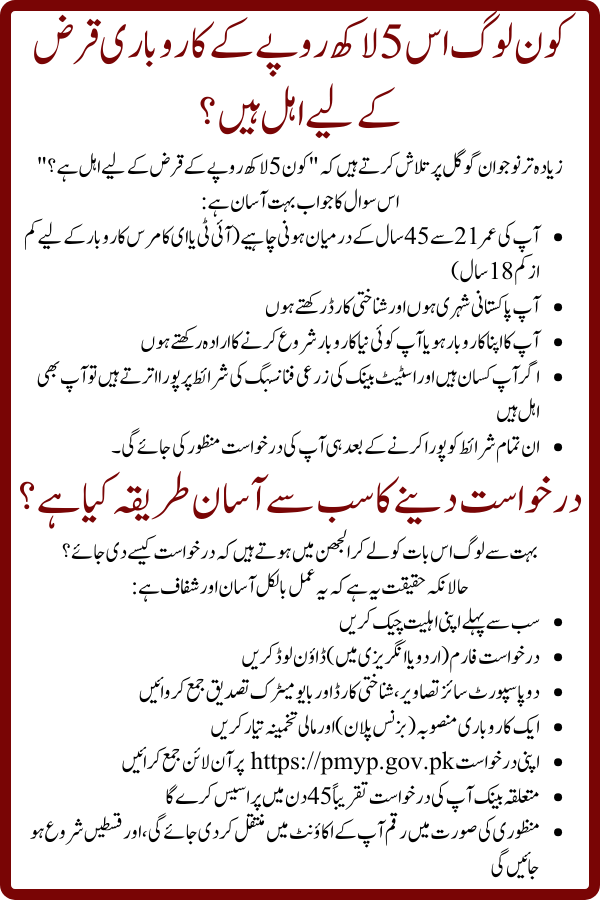

Who is eligible for this 5Lack Loan for Business?

Most of the young people search on Google that “Who is eligible for Rs 5 lakh loan?”

The answer is simple:

- Your age should be between 21 to 45 years (above 18 years for IT or e-commerce)

- Be a citizen of Pakistan and hold a national identity card

- Own or plan to start a business

- If you are a farmer and meet State Bank’s agricultural financing criteria, you are also eligible

- The application will be approved only after fulfilling all these conditions.

What is the easiest way to apply?

Many people get confused about how to apply. The fact that the process is straightforward and transparent:

- Check your eligibility first.

- Download the application form (Urdu or English).

- Submit two passport size photographs, identity card and biometric verification.

- Prepare a business plan and financial projections.

- Your request https://pmyp.gov.pk Submit online at

- The concerned bank will process your application in about 45 days.

- In case of approval, the money will be transferred to your account and the installments will start.

What are the loan terms and payment system?

This is the most frequently asked question: “How to repay the loan?”This loan will be repaid in 36 months in easy monthly installments. The bank may also grant a grace period of some months as per its policy. There will be no additional charge if you wish to pay early. But remember if the installment is submitted late, there will be negative report on e-CIB which may make it difficult to get loan in future.

Check Also: BISP 8171 Check Online by CNIC

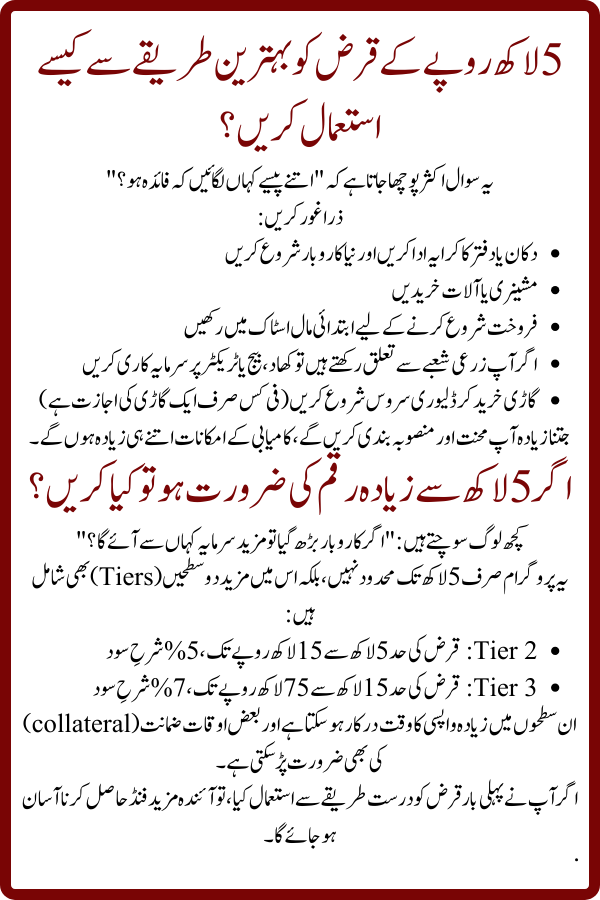

How to best use this Rs 5Lack Loan for Business?

The question that often comes up is “Where to invest so much money that it will be profitable?”

Just think:

- Pay rent for a shop or office to start a new business.

- Purchase machinery or equipment.

- Keep the initial goods in stock to start the sale.

- If involved in agriculture sector, invest in fertilizer, seed or tractor.

- Start a delivery service by purchasing a vehicle (only one vehicle is allowed).

The more hard work and planning you do, the more certain success will be.

What to do if the amount is more than 5 lakhs?

Some people think “If the business grows, where will more money come from?”

This program also includes Level 2 and Swim:

- Tier 2: Loan from Rs 5 lakh to Rs 15 lakh, with 5% interest rate

- Tier 3: Loan from Rs 15 lakh to Rs 75 lakh, with 7% interest rate

- These levels may require longer repayment periods and in some cases collateral.

- If you used the loan well the first time, it will be easier to proceed.

When should the application be submitted?

The simple answer to this question is: “As soon as possible!” Because after July 2025, the interest-free facility of this loan may end. If you delay in applying, then this unique opportunity will be lost.So start preparing today and get all the papers complete.

Check Also: CM Punjab Solar Scheme 2025

The result

An interest-free loan of Rs 5 lakh under the Prime Minister’s Youth Business and Agriculture Loan Scheme is an invaluable opportunity for the youth. This can not only help in growing the business but will also increase your independence and confidence. If you have passion and courage, this money can change your fortune. Just don’t be late. Your request https://pmyp.gov.pk Submit on and avail this golden opportunity.

Official Website: https://pmyp.gov.pk